Overview

The Group’s results for the year ended 30 June 2020 were achieved in an exceptionally tough and unusual economic, social and financial environment. All the markets in which we operate were adversely affected by the COVID-19 Pandemic without exception. In these circumstances, the results are testimony to the outstanding performance of Team Simbisa and reflect the resilient nature of the Group’s business model and brands.

The challenging business environment in Zimbabwe persisted, compounded by the COVID-19 induced business restrictions. The Zimbabwean market continues to operate under hyperinflation with currency depreciation accelerating significantly in the last quarter of the reporting period. As a result, customer discretionary spending remains under significant pressure. The business has therefore remained focused on offering “value for money” meals to our valued customers.

In the Regional markets in which we operate, authorities also implemented various measures in response to COVID-19 resulting in reduced economic and social activity. The business managed to keep the majority of its restaurants open, under reduced trading hours and with limitations on “sit-in” service. The major exception was Mauritius which was under a full lockdown from 20 March to 4 May 2020 during which no trading occurred.

These financial results were also impacted by the depreciation of regional currencies which lost significant value against the US dollar. Regional currencies in our major markets outside Zimbabwe depreciated by between 3% and 41% against the United States dollar in the period under review. Despite this, the Board is pleased with the performance of the Regional segment which recorded, in USD terms, a 7% decline in Revenue and a 2% increase in Operating profit (excluding the impact of IFRS 16) for the year ended 30 June 2020.

Within the context of such a difficult trading environment and reduced economic activity due to COVID-19, the business has performed incredibly well.

Revenue and profit in Q4, although below normal levels, recovered better than we had previously forecasted. The Group’s prompt response to the crisis on the operating expenditure side allowed the business to defend the operating profit margin in the last two months of the quarter. Our multiple channels inclusive of take-away, drive-thrus, curb-side collection and delivery allowed for the majority of our restaurants to largely remain open.

The CEO’s detailed report and the financial performance indicate that the Group has been able to sustain its viability in the initial shocks of the pandemic and is steadily recovering despite the depressed economic levels.

I am therefore very proud of the loyal, noble, and selfless efforts of our Simbisa staff, management and the Board in these unprecedented times. The Simbisa Team has worked closely with all stakeholders, including government authorities and business associates to agree, implement and maintain measures that protect the health and safety of our employees and customers while continuing to provide affordable and quality meals to our valued customers.

Significant accounting and reporting developments

i. Adoption of Hyperinflation Accounting

As indicated in the last report, the Group has adopted the International Accounting Standard (“IAS”) 29, “Financial Reporting in Hyper-Inflationary Economies”, in preparing its financial reports. The performance highlights in this report are in inflation-adjusted terms except where specific reference is made to historical financial indicators.

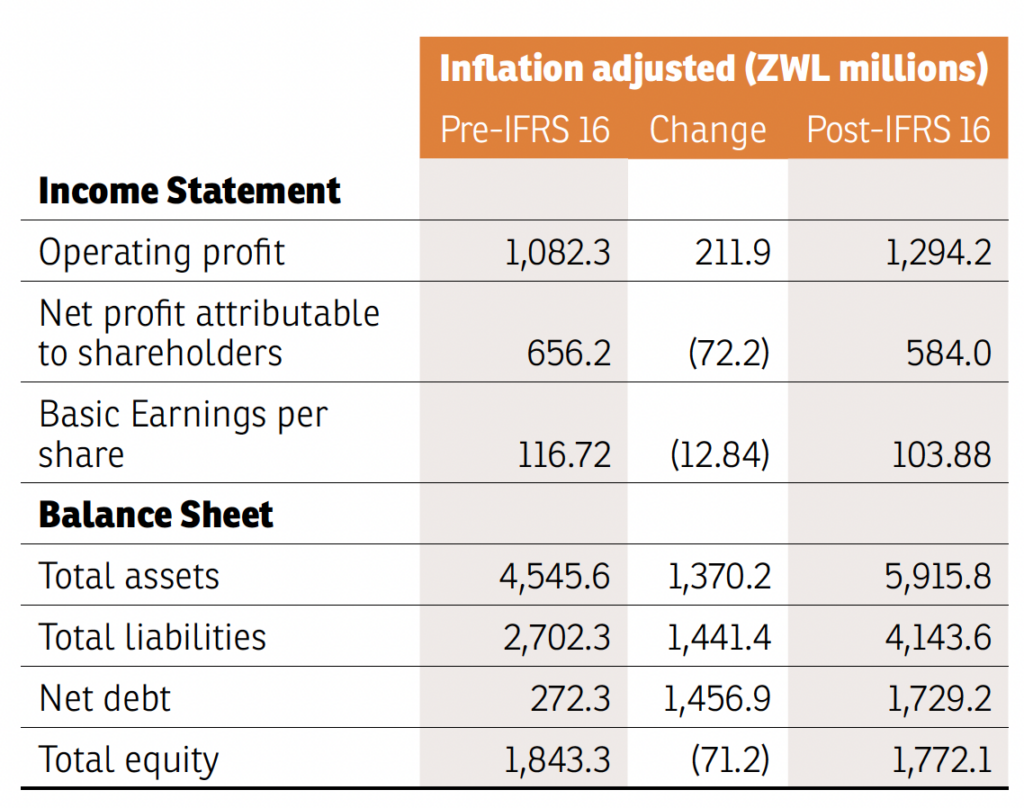

ii. Adoption of International Financial Reporting Standard (IFRS) 16: Leases

The Group implemented the new accounting standard on leases, IFRS 16, with effect from 1 July 2019. This new standard has a material impact on the Group’s results as it operates the majority of its stores under operating lease agreements. The new standard aligns the presentation of leased assets more closely to owned assets, bringing both a right of use asset and lease liability on the balance sheet. Rental expenses previously recorded on a straight-line basis are now replaced by depreciation on the Right of Use Asset, straight-lined over the term of the lease, and interest expense on the lease liability which reduces over the lease term.

The adoption of the new standard has had the following notable implications on the Group’s results for the year ended 30 June 2020:

iii. Partial compliance with International Financial Reporting Standards

As reported in our annual financial statements for the year ended 30 June 2019, legal instruments issued by the Government of Zimbabwe on the reintroduction of the Zimbabwe dollar resulted in market-wide impracticability in achieving full compliance with IFRS due to conflicts with International Standard (“IAS”) 21: ‘The Effects of Changes in Foreign Exchange Rates.’ The Independent Auditors issued an adverse audit opinion on the Group’s financial results for the year-ended 30 June 2019 in accordance with the guidance issued by the Public Accountants and Auditors Board (PAAB) in Zimbabwe. The above matter continues to affect the corresponding numbers and opening balances in respect of the Group’s June 2020 financial results.

The unavailability of exchange rates for the Zimbabwe dollar, that meet the definition of a spot exchange rate as per IAS 21 continued over the financial year under review and has resulted in the Group’s inability to comply with IAS 21. As a result, the Independent Auditors have issued an adverse audit opinion on the financial statements for the year ended June 2020.

The Directors have exercised reasonable and prudent judgement in the preparation of these inflation-adjusted consolidated financial statements. However, the above-mentioned marketwide distortions may have an impact on the information presented in the inflation-adjusted consolidated financial statements. As a result, the Directors advise users of the financial statements to exercise due care.

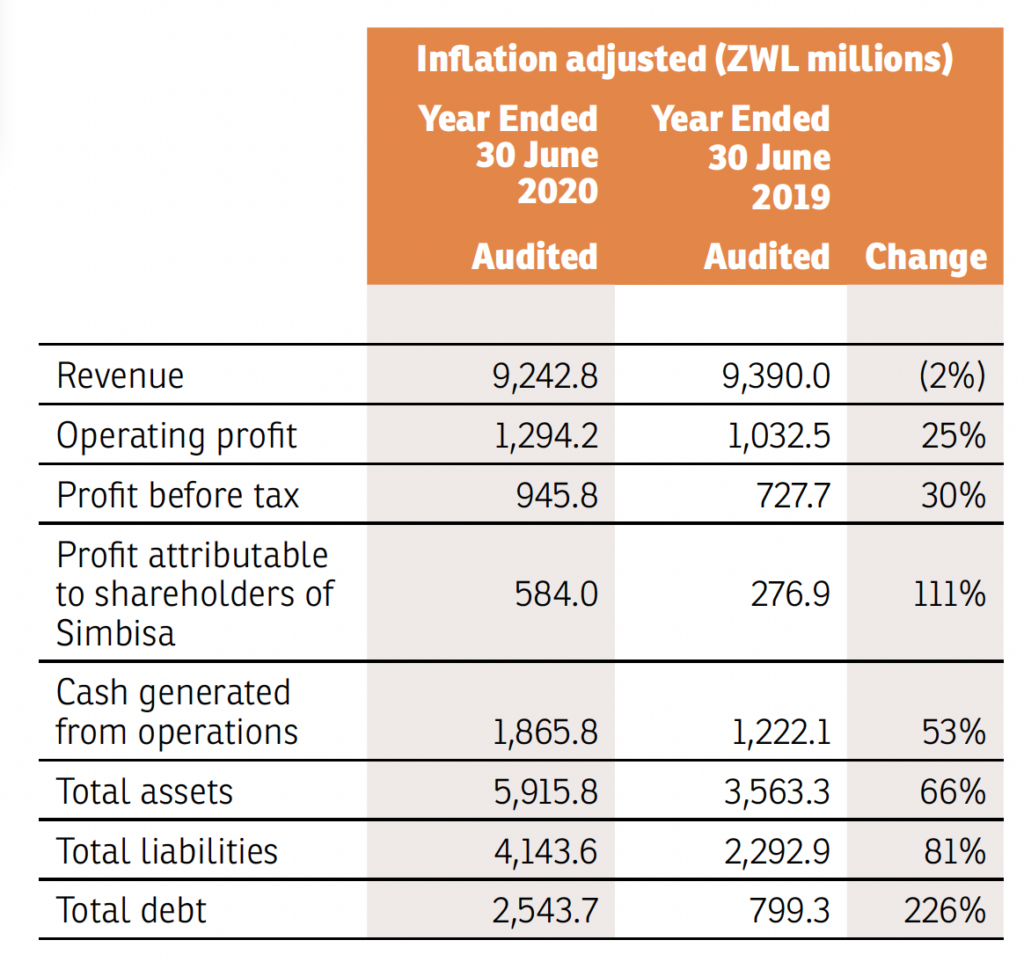

Financial performance highlights:

Key highlights are as follows:

- Operating profit increased by 25%. Profit attributable to shareholders increased by 111%.

- The Group incurred a net monetary gain of ZWL 273.1m. This is a result of the Group maintaining a net local currency monetary liability position in Zimbabwe to preserve value.

- The Group recorded a foreign currency exchange gain of ZWL 486.6m. This is driven by a significant improvement in the Group’s net foreign currency position during the period under review and depreciation of the Zimbabwe dollar against the United States dollar.

- The Group recorded a strong growth of 53% in Cash generated from operating activities. During the period under review, the Group spent ZWL 708.4m on capital expenditure (ZWL 260.1m in Zimbabwe and ZWL 448.3m in the Region). Capital expenditure was below planned levels as the Group reviewed new store expansion targets in the last quarter due to the impact of COVID-19.

- The Group’s Balance sheet remains sound. Total borrowings increased by ZWL 764.4m with ZWL 1456.9m as a result of implementation of IFRS 16. Excluding the increase arising from IFRS 16, the increase in borrowings amounted to ZWL 307.1m. This is primarily driven by an increase of ZWL 279m in Zimbabwe to fund expansion activities.

Due to this performance, the Board resolved to declare a final dividend of ZWL 18 cents per share. This takes the full year dividend to (historical cost) 23.07 ZWL cents per share (FY19: 1.91 ZWL cents per share). Furthermore, the Board approved a dividend of ZWL 5,059,663 to the Simbisa Employee Share Trust.

Corporate Governance

There were no changes to the Board during the period under review.

Outlook

Looking ahead, our priority remains to continue operating our business in a safe and convenient way whilst maintaining optimum returns to our stakeholders including employees, investors and the communities we operate in.

In the short-term, we expect the business performance to continue on an upward trajectory as economies reopen further and population lockdowns ease across all our markets. The Board is closely monitoring the situation and will continuously assess the business’s readiness to implement effective remedial action in response to any further potential business disruptions. The Board continues to review the liquidity position of business units on a regular basis. These reviews have shown that our business remains adequately capitalised although there is a general liquidity squeeze in Zimbabwe as far as the Zimbabwe dollar is concerned.

The Group is confident of successfully navigating through these uncertain times. The business is leveraging on its key strengths which include the geographically diversified operations, strong brand positions across the resilient low to medium LSM segments, our adeptness at Quick Service Restaurants and the increase in alternative sales channels outside of the traditional sit-in service as well as our good cash generation ability.

Our Dial-a-Delivery App (DAD) is developing into a market leader, and the Group is investing further in the delivery channels.

The Group remains committed to its long-term priorities including growing the financial contribution of the business operations outside Zimbabwe, growing its online and delivery business and improving the return on investment through operational efficiencies. The Group will continue its focused investment strategy, investing only in high return brands and store locations in our existing markets and brands that are likely to emerge from the COVID-19 crisis even stronger.

In the year under review, the Group opened 14 outlets in Zimbabwe and 21 outlets in the Regional markets to close the year with an overall store count of 488 outlets. There are 51 new stores in the pipeline for the FY2021 financial year.

Appreciation

Sadly, I wish to report that the Group lost two key senior managers in the year under review. Mr. Pachawo Chipurura and Ms. Shupiikai Chapendama passed away in February 2020 and September 2020 respectively. They both had long and successful careers with the Group spanning over two decades each. We wish to place on record our immense appreciation of their selfless dedication to the Group’s success. They will be greatly missed by us and their families.

On behalf of the Board, I would like to express the Board’s gratitude, and appreciation of our staff, Management and the Executive Team’s incredible dedication to duty, self-sacrifice, commitment, loyalty to our customers and their unflinching hard work during this COVID-19 period. I also thank our loyal customers for their continued support, and acknowledge with thanks to our suppliers, business associates, and stakeholders. The Group will continue to seek growth and opportunity in all our markets.

A. B. C. Chinake

Independent Non – Executive Chairman

14 October 2020